95% of the 500 companies use Azure, relying on cloud services to build and deploy multiple applications in a responsive and agile way. Here is how the financial firms use these services to run their operations seamlessly.

-

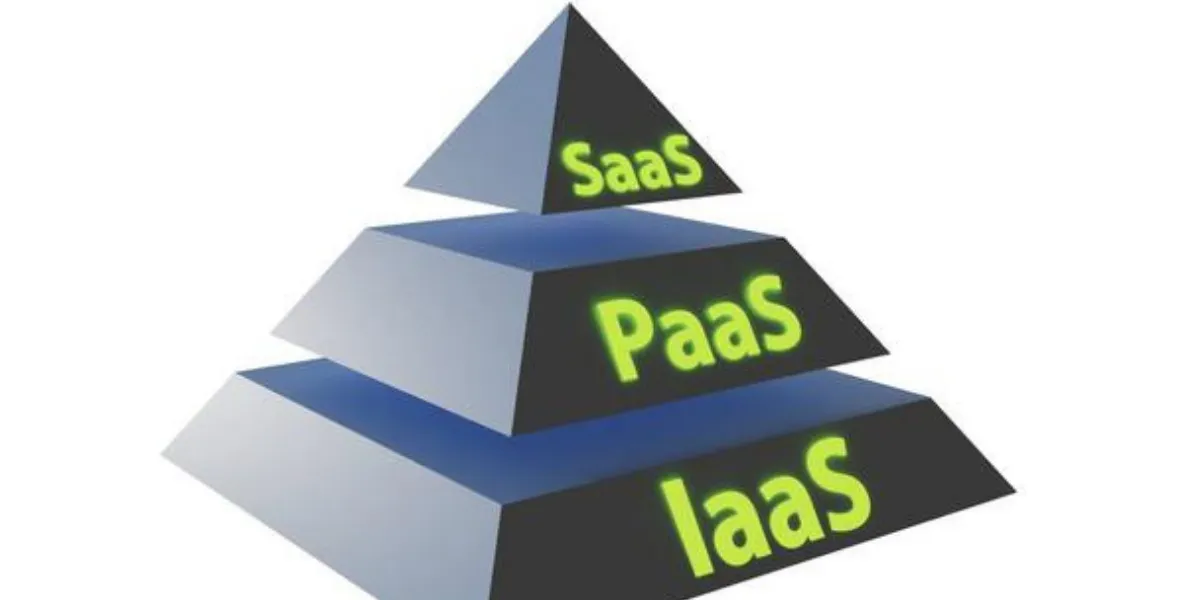

IaaS – Infrastructure as a Service (IaaS) is a type of cloud computing that is provisioned and managed online. It provides the financial firms with the components such as storage and servers often located in the dedicated data centres and cybersecurity protection through networking firewalls and more.

IaaS can easily scale the services required by only paying for what is used and allowing the firm to respond to the shifting business conditions.

-

PaaS – Platform as a Service (PaaS) includes the infrastructure components of IaaS along with the business analytics, OS, database management and development tools. Using these platforms and services, firms can build, test, manage, deploy and update web applications in the cloud.

As more number of small and medium-sized firms move to the cloud, the uptake of the PaaS and IaaS is also increasing. It is also said that these services will overtake Software as a Service (SaaS) eventually. Azure supports this and offers several PaaS and IaaS solutions for financial firms.

Azure’s IaaS offers the usage-based billing model rather than the reserved capacity. The lack of upfront costs makes it an affordable choice for financial firms of any size. PaaS helps the firm build and deploy bespoke applications and solutions using a completely-managed platform. It also offers the developers a pathway to implement load balancing, OS patching and capacity provisioning.

Microsoft Azure provides a complete solution for financial firms. Want to know about this all in all service provider? Learn it with the Microsoft Azure cloud certification course at EkasCloud, which is easy to learn and more efficient for your career.

Relevant courses that you may be interested in: